Table Of Content

- SEABOURN UNVEILS 'THE COLLECTION': EXCLUSIVE CRUISES FEATURING UNIQUE SHORESIDE EXPERIENCES

- Should I invest?

- Investing in cruise line stocks in 2024

- Investing in Cruise Stocks in 2020

- Thousands of passengers affected as Princess Cruises delays new ship

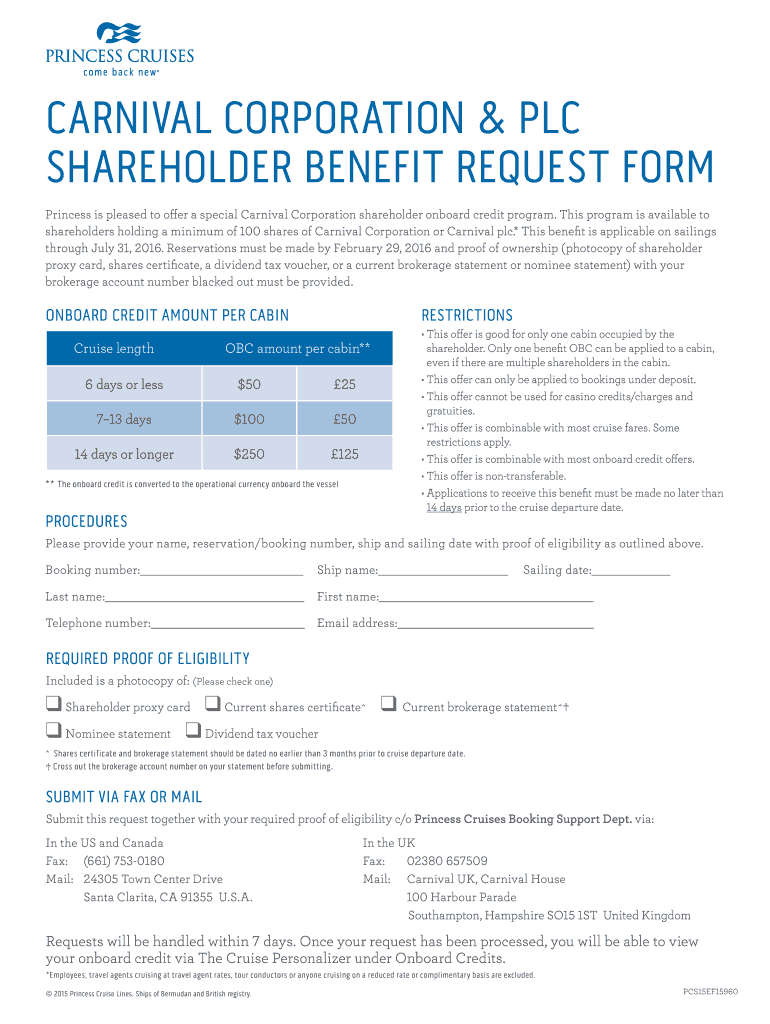

- Onboard Credit Amount and Distribution

- Cruise Stocks to Buy Now

That ‘per stateroom’ part is key, because if you and your partner were both to invest in Carnival shares, and then you booked a stateroom together, only one of you could claim the Princess Cruises shareholder benefits. Guests who elect to rebook will receive future cruise- and onboard-credits depending on the cruise they select. Guests will also have the option to cancel and receive a full refund of the cruise fare. If you qualify for the ex-military OBC, it is the same as owning the shares for Princess, but evidently not for the other Carnival cruise lines. With the economy normalizing and a pent-up demand for travel, the company plans to expand its cruise line business by adding three more ships this year.

CCL Stock Price and Chart — NYSE:CCL - TradingView

CCL Stock Price and Chart — NYSE:CCL.

Posted: Fri, 19 Apr 2024 22:27:49 GMT [source]

SEABOURN UNVEILS 'THE COLLECTION': EXCLUSIVE CRUISES FEATURING UNIQUE SHORESIDE EXPERIENCES

Actual offerings may vary from what is displayed in marketing materials. Click on the following links to stay updated on current Cruise Updates and Health & Safety protocols. Carnival could complete a reverse stock split to help reduce its outstanding share count.

Should I invest?

You cannot each purchase 100 shares and expect to get double the onboard credit. You will make a stock investment with the 2nd 100 shares but not get the credit. The company provides expedition cruising and adventurous travel opportunities through its fleet of ten owned expedition ships and five seasonal charter vessels. Most of its guests are small groups of affluent people who are extremely loyal. Most of its expeditions are expensive, ranging between $5,000 and $25,000, depending on the itinerary.

Investing in cruise line stocks in 2024

You might be among those with an upcoming cruise booked on one of Carnival's brands. Here's a step-by-step guide on how to invest in its shares and some things to consider before buying. World's largest cruise company releases annual report detailing its global sustainability performance and progress, including surpassing several sustainability goals well in advance MIAMI , April 10, ... It’s also important to note that the Shareholder onboard credit will be non-refundable. Any unspent Shareholder onboard credit cannot be reimbursed or carried over to future cruises. Nevertheless, cruise lines tend to have a passionate customer base with plenty of repeat passengers.

Investing in Cruise Stocks in 2020

It has a 100% vaccination policy that it extended indefinitely in November 2021. Since all passengers must be vaccinated, Norwegian is able to offer mask-free cruises with no social distancing requirements. I can’t advise you which is the best, but I personally chose to buy my Carnival shares through an investing platform called etoro. I chose this one because it is one of the most popular platforms with 20 million registered users and has great reviews and low fees. To buy shares in any company, you’ll typically need to use a stockbroker.

Historical Prices for Carnival

The credit appears on your onboard account at the time of sailing and is nontransferable. It can't be used for any activities purchased prior to sailing, nor for service charges/gratuities on board. Considering how much the pandemic continues to affect cruise lines, investing in them is relatively risky. The cruise line business has high operating costs, and many cruise companies have lost a lot of money. Investors in search of safe stocks may want to stay away from this industry right now. According to Lindblad, a majority of guests opted for future travel credits over a refund for voyages that were cancelled or rescheduled due to the pandemic.

Over the long term, cruise line stocks may be a good value investment provided you are comfortable with some volatility. However, cruise line companies are reporting strong sales for upcoming cruises, which indicates a rebound in demand. But they've also had to take on significant debt to get through the pandemic, and revenues aren't predicted to get back to pre-COVID numbers until 2024. Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

Onboard Credit Amount and Distribution

However, it is now experiencing a steady increase in revenues and future bookings. At the end of Q1 2022, revenues surpassed consensus estimates by $10.7 million to register $67.8 million, led by an increase in expeditions and trips. With limited operational capacity and strong demand, the company is gaining through higher pricing, mostly driven by on-board bundled offers. As a result, it is ramping up its capacity to take nine more ships through 2027.

Cruise Stocks to Buy Now

Once you complete the order page, click to submit your trade and become a Carnival shareholder. Carnival CEO Josh Weinstein joins 'Money Movers' to discuss how the bridge collapse will affect Carnival's operations, security concerns in the Red Sea, and any sign of slowing demand. Carnival Corporation said Wednesday the Francis Scott Key Bridge collapse in Maryland could have a negative effect on its full-year earnings to the tune of up to $10 million. Proceeds from the offering of senior unsecured notes and cash on hand to be used to redeem €500 million 7.625% senior unsecured notes due 2026; cash on hand to repay $800 million of the term loan faci... And Carnival Cruise Lines CEO Arnold Donald talks about how his company is preparing for the post-pandemic world. Investors just woke up to the fact that Carnival's fourth-quarter earnings report actually wasn't that great.

It will take time for the company to recover as it is still not operating at full capacity. However, if demand continues to be upbeat, the cruise line has the capacity to recover soon. When people have a little extra cash, they indulge in offerings from these companies. The SPDR S&P 500 ETF Trust (SPY -0.87%) was the largest holder at nearly 100 million shares. However, the S&P 500 ETF had a tiny allocation at 0.04% of the fund's total holdings, so there are better ways to gain exposure to Carnival. Carnival has undertaken several actions to improve profitability, which it expects to start achieving in the second half of 2023.

The sophisticated cruisers with the highest status, with the most days at sea, never show off their fancy room keys. Some cruise lines are better than others at wiping down commonly touched surfaces, but I don't take any chances. I avoid touching things others frequently touch, and I wash my hands frequently. I prefer to buy as I go and take advantage of happy hour and other drink specials that are available on certain cruise lines. I also check the beverage policy in advance and bring on my own wine, if allowed. MONFALCONE, Italy, (April 19, 2024) – Princess Cruises and ship builder Fincantieri today announced the mutual decision to postpone the delivery of the next Sphere Class ship, Star Princess.

In place of some of those sailings, Princess has added a new inaugural voyage for Star Princess out of Barcelona on Oct. 4, 2025. Disney has a track record of delivering solid growth in revenues and profits. The company’s Disney+ and other streaming services have gained significant consumer traction in the past couple of years. Despite a strength in demand, the bottom line remains weak due to a significant amount of leverage.

Given its cash burn rate of $1.9 million in Q1 2022, it has sufficient liquidity to carry out its business plans. As long as leisure cruising remains upbeat, the company’s performance will improve further. Like others, the company’s business was hard hit during the pandemic.

The company operates nine cruise line brands with over 90 ships visiting more than 700 ports annually. Under the new policy, the Shareholder and Military onboard credit will no longer be combinable for guests who qualify for both benefits. This means that eligible individuals who are both military members and shareholders will need to choose between the two types of credits rather than being able to benefit from both as they could previously.

No comments:

Post a Comment